nassau county property tax rate 2021

The median property tax on a 48790000 house is 600117 in New York. You can pay in person at any of our locations.

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Unsure Of The Value Of Your Property.

. Looking for more property tax statistics in your area. Laura Curran Getty Seven weeks ahead of election day Nassau County Executive Laura Curran is offering voters a. The deadline to file is March 1 2022.

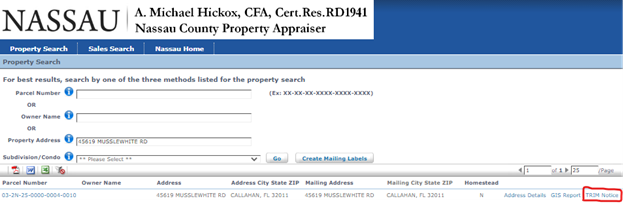

- Nassau County Property Appraiser A. Based on the CPI used for 2021 previously homesteaded properties will. Explore how Nassau County applies its real estate taxes with this thorough review.

The median property tax also known as real estate tax in Nassau County is 157200 per year based on a median home value of 21360000 and a median effective property tax rate of 074 of property value. The TRIMs also reflect the proposed millage rates set by the various taxing authorities. How To Get To Comfort Suites.

Nassau County Property Appraiser. While the 2 percent figure is well above the 156 percent increase provided for in 2021 its good news for Nassau County homeowners already struggling with some of the highest property tax rates in the US. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

The amount of your 2021 STAR credit or STAR exemption may be less than the amount shown above due to either of the following reasons. How to Challenge Your Assessment. TRIM forms notify you of the proposed values and millage rates for the upcoming tax bills.

20212022 Final Assessment Rolls 2022 Final Assessment Roll for Town of Hempstead. Cobra charges only 40 of the tax reduction secured through the assessment reduction. If you are able please utilize our online application to file for homestead exemption.

Nassau County its 3 towns 2 cities 62 school districts and most of its incorporated villages offer a. In Nassau you file with the Assessment Review Commission and the deadline is March 1 2021. You might be interested.

Homestead properties can increase no more than 3 or the consumer price index CPI whichever is lower. Rules of Procedure PDF Information for Property Owners. Assessment Challenge Forms Instructions.

If you would like to schedule a physical inspection of your property please send an email to ncfieldnassaucountynygov or a letter to 240 Old Country Road 4th floor Mineola NY 11501. Instantly view essential data points on Nassau County as well as NY effective tax rates median real estate taxes paid home values. Senior Citizens Real Property Tax Exemption.

Between January 3 2022 and March 1 2022 you may appeal online. Nassau County Tax Collector. They state the fair market value or just value Amendment 10 value or assessed value exempt value s classified use value and taxable value of your property.

Nassau property owners pay more than 4x more in property taxes than the average American. 20212022 Final Assessment Rolls. The New York state sales tax rate is currently 4.

240 Old Country Road. September 14 2021 0444 PM. 097 of home value.

Tax amount varies by county. The Land Records Viewer allows access to almost all information maintained by the Department of Assessment including assessment roll data district information tax maps property photographs past taxes tax rates exemptions with amounts and comparable sales. It is also linked to the Countys Geographic Information System GIS to provide.

For persons over the age of 65. Nassau County Tax Lien Sale. Nassau County Stats for Property Taxes.

From The County Insider Office of the Nassau County Manager August 24 2021 82321 400 pm. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. You may file an online appeal for any type of property including commercial property and any type of claim including errors in your propertys tax class or exemptions.

Nassau County has one of the highest median property taxes in the United States and is ranked 2nd of the 3143. ARC s online Sales Locator is available to help you evaluate the accuracy of the new assessment for your. The median property tax on a 48790000 house is 512295 in the United States.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. In Suffolk residents file with the town in which they reside and the deadline is May 18 2021. Find All The Record Information You Need Here.

86130 License Road Suite 3. Whether you are presently living here just considering moving to Nassau County or planning on investing in its property study how district real estate taxes function. This is the total of state and county sales tax rates.

Although taxable values have increased Countywide many property owners are protected by the Save our Homes SOH Amendment which caps the amount the assessed value can increase. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Posted on August 24 2021 August 23 2021 by Suanne Thamm.

One-time payments to. In-depth Nassau County NY Property Tax Information. Your individual STAR credit or STAR exemption savings cannot exceed the amount of the school taxes you pay.

Notice of Proposed Property Taxes for Nassau County property owners. Florida is ranked number twenty three out of the fifty states in. The plan which will result in payments of up to 375 for qualifying residents has been approved by the Nassau County Legislature.

Nassau County New York sales tax rate details The minimum combined 2021 sales tax rate for Nassau County New York is 863. Nassau County collects on average 179 of a propertys assessed fair market value as property tax. The 2021 Nassau County property tax rate was 515 per 1000 of full market value plus municipal tax rates for towns andor villages school district taxes and taxes for special districts.

Ad Find County Online Property Taxes Info From 2021. The median property tax on a 48790000 house is 873341 in Nassau County. In your correspondence with the Department of Assessment please include the address of the property you wish.

This exemption provides reductions of between 5 and 50 on county town and school taxes but no reduction in special district taxes. School current tax bill for 07012021 to 06302022. The County Executive has proposed taking 100 million from Nassau Countys allocation of funds from the American Rescue Plan and distributing this money directly to residents.

This tax cap applies to the Nassau County general tax levy which is a portion of all homeowners tax bills. Remember you can only file once per year. Whether you are already a resident or just considering moving to Nassau County to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Nassau County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Learn all about Nassau County real estate tax. Yearly median tax in Nassau County.

Fernandina Beach FL 32034. Schedule a Physical Inspection of Your Property. The Nassau County sales tax rate is 425.

Nassau County New York To Auction Gos After Bond Rating Upgrades Bond Buyer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Long Island Property Tax Reduction Savings Suffolk Nassau Counties Tax Reduction Services

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

Nassau County Property Appraiser How To Check Your Property S Value

Best Of The Nassau County 2021 08 06 By The Island 360 Issuu

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Real Estate Market Updates Nassau County Ny Dean Miller Real Estate

Property Taxes In Nassau County Suffolk County

Filing Fees Nassau County Clerk Of Courts And Comptroller

All The Nassau County Property Tax Exemptions You Should Know About

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Ny Property Tax Search And Records Propertyshark

2022 Best Places To Buy A House In Nassau County Ny Niche

Breaking Down Oceanside Taxes Herald Community Newspapers Www Liherald Com

Tax Grievance Deadline 2023 Nassau Ny Heller Consultants

Nassau County Ny Property Tax Search And Records Propertyshark